The competition in the Indian smartphone space has reached a tipping point. Foreign brands, especially the Chinese smartphone manufacturers have clouded the Indian smartphone market with their feature-packed offerings. Not to mention that they are being sold at aggressive price-points. Once dominating the Indian smartphone industry, local brands such as Intex, Micromax, and Karbonn have lost the battle to Chinese brands in the homegrown market.

As per the data shared by Tanvi Sharma, Research Associate at Counterpoint Research, Indian smartphone brands gathered a market share of 45% of the total smartphone market in the year 2015. Chinese players' share was as low as 9% in the same year. Today, the market is largely governed by Chinese companies. According to Counterpoint Research, Chinese brands capture a record of 66% of the Indian Smartphone market in Q1 2019.

If we take a look back in the history, Micromax Canvas series, Intex Aqua series, and Lava Iris series handsets once ruled the Indian smartphone space. These entry-level Android phones were a household name in the early days of the smartphone era in the Indian market. It was later in the year 2016 when the Chinese smartphone manufacturers started to gain the market share aggressively. In fact, Xiaomi managed to grab a spot in the top 5 list in the same year.

Fighting for their survival in the Indian smartphone space, some of these local brands ventured into audio, TV and home-appliances categories. Some are now even leaping towards global expansion; however, analysts believe Indian brands should focus on sub 7k devices, especially the feature phones segment which still account for a huge market share in India. While we hope for them to rekindle their products in the market, here are certain areas we think went wrong for the local companies in the first place. Moreover, we will also let you know what these Indian brands are up to these days and what are their future strategies.

Xiaomi Mi 3 Launch: Major Turning Point For Indian Brands

While a number of factors contribute to the beginning of the end of Indian smartphone brands' reign, I believe the launch of Xiaomi's Mi 3 smartphone in the year 2014 was the key factor. The handset simply changed the Indian smartphone landscape overnight. Xiaomi Mi 3 offered the then flagship specs- Snapdragon 800 chipset, crisp 1080p screen and capable camera hardware at one-third of a price of 2014 flagship smartphones such as LG G3, Nexus 5, Sony Xperia Z3, Moto X, etc. As a result, Mi 3 took the Indian market by storm and was sold in huge numbers. Products from homegrown brands which once ruled the market just couldn't match the features and performance of Xiaomi's beefier Mi 3.

Xiaomi realized that the company has hit the sweet spot and thus kept the trend in motion with similar offerings. It was just a matter of time that other popular Chinese brands ventured into the Indian smartphone space, creating more troubles for local smartphone manufacturers. The data shared by Counterpoint Research mentions that Chinese brands garnered 51% market share in less than 3 years, pushing Indian brands down to 16%. Effective marketing skills, aggressive pricing models, online sale strategy and powerful spec-heavy products were the major driving factors of the Chinese company's dominance in the Indian market.

Today, Xiaomi rules the Indian smartphone market. As per the most recent reports by IDC (International Data Corporation) for the first quarter, 2019, Xiaomi managed to ship 9.8 million smartphones for a total of 30.6 per cent market share. The company also dominates the online channel with a market share of 48.6 per cent in Q1 2019. Samsung comes training at second and Vivo stands at the third position.

Where Do Indian brands Stand In Terms Of Market Shares In 2019?

We reached out to IDC and Counterpoint Research to understand the market share of Indian smartphone brands. Ms. Upasana Joshi, Associate Research Manager - Client Devices, IDC India informed us that the current combined market share of Indian smartphone manufacturers- Intex, Lava, Micromax and Karbonn in the smartphone category is just 7.6%. The Feature Phone market share of these brands is considerably higher and stands at 14.4% in CY 2018. Feature phones still account for a big market in India, especially in rural areas and tier III cities.

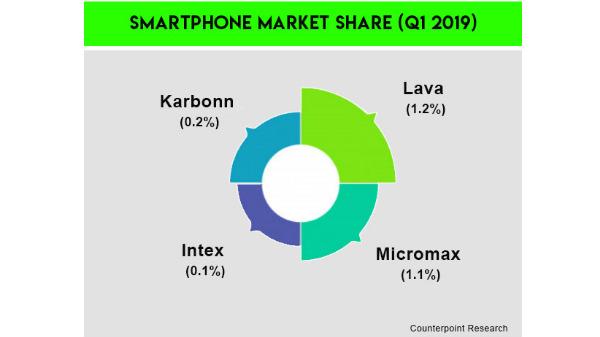

Smartphone Market Share- Indian Brands

Based on the data shared by CounterPoint Research, the individual market share of Indian brands in the smartphone market is as follows: Intex (0.1%), Lava (1.2%), Micromax (1.1%) and Karbonn (0.2%).

Feature Market Share- Indian Brands

For the feature phone category, Intex's share is 1.4%. Micromax and Karbonn cover 2.4 % and 4.4% respectively in the Q1 2019. Lava once again grabbed the top spot with a 12.9% market share in the feature-phone category.

As per CounterPoint Research's Q1 2019 report, Lava doubled its market share, becoming the Number 2 brand in the 2G feature phone segment. As per the reports, Lava was second to Samsung with a difference of only 2% in the overall market share in the homegrown market.

We also reached out to local smartphone brands for their current market share in the homegrown market. Intex, Micromax and Karbonn seemed unavailable to comment on the questions at the time of filing the story. As per our internal sources, Intex is entirely shutting down the smartphone division in the Indian market. However, we are yet to receive an official statement from the brand on the matter.

Tough times for Indian Smartphone Brands

Once a dominant player in the smartphone segment, Micromax is now gradually fading away from the homegrown smartphone space. We haven't got any response from Micromax for the company's current market share, future products and marketing strategies. However, the company responded for its after-sales service network, which you can read later in the story.

Lava actively responded to our queries. As per the Indian smartphone brand, the company still holds its sales below 5K segment by taking over 15% market share in this segment. Lava aims to be No.1 in this segment in the coming year. The company has set up two manufacturing facilities and a repair factory with approximately 300,000 square feet area in Noida itself. Lava claims that the two manufacturing plants have a production capacity of 40 million phones per annum.

Tejinder Singh, Head- Product, Lava International said, "We see a huge potential in the sub 10k segment. We know we can be the global leaders in this segment. In Feature Phones, we are the number 2 brand in 2G phones (Q1 results by Counterpoint Research) and will continue to dominate the segment with new innovative products planned during the year with a focus on high battery back up in the category along with the right audio experience for our consumers. In the smartphone segment, we will launch products customized for Indian consumer's need and target first-time smartphone buyers with a focus on battery, audio and region-specific features."

What About Local brands’ After-Sale Service Support In India?

The homegrown brands have a responsibility towards meeting after-sale service requests of their user base. We reached out to smartphone brands to seek some information on the after sale service support to their consumer base. Intex and Karbonn once again seemed unavailable to provide any details on the after-sales service.

Lava informed that the company's sales service network is one of the largest in the country with over 1,000 professionally managed service centres. These are not third party service checkpoints but the company-owned service centres to address consumer's requests. If you are a Lava user and have faced any issues with the company's after-sale service support, feel free to write to us.

As far as Micromax is concerned, the company also gave some information related to the after sales service support. The company mentioned, "Over the years, we have invested diligently and laid down a large service network of 650+ walk-in service centres pan India to ensure easy access for every user. These service centres are located even in some of the most interior parts of the country so that anyone with a Micromax phone can have a solution to their issues even after the purchase has been made. Majority of these are fully-enabled to handle any kind of hardware/software problems. On average, we ensure a consumer's complaint is responded to within 24 hours and the required repair/replacement is made in less than 7 days."

In the absence of other local brand's response over the after-sales service support, we again reached out to IDC. The research corporation informed that Indian smartphone brands were largely dependent on third-party platforms with multiple brands being serviced under one roof. Therefore, the service support will not be impacted much in the scenario of brand's being not responsive to serve queries of the consumers.

What Can Indian Brands Do To Regain Some Market Share?

It is quite evident by now that the Indian smartphone market is dominated by China-based vendors. It's almost impossible to trump the Chinese mobile devices in terms of specifications and performance. We believe Indian smartphone manufacturers will have to come up with a strong product portfolio to regain the lost market share. Let's understand how Indian brands can regain some of the lost market share in the homegrown market.

5G Enabled Low-Cost Phones Can Be A Good Start To Regain Lost Market Share

Chinese smartphone manufacturers focused on bringing faster 4G products while Indian brands were still pushing 3G smartphones to consumers. Now with 5G being the hot topic, the Indian smartphone brands have the chance to flip the coin. It's a daunting task; however worth considering when stakes are so high. The Government of India aims to kickstart the deployment of ultra-high speed 5G networks in the country by 2020. Smartphones is just one segment where Indian phone brands can focus to regain some lost market share. Additionally, local brands can also consider other use cases of 5G networks such as education, farming and next-gen manufacturing. 5G will also give a big push to the use of IoT enabled products in the Indian market, a segment that can be considered by the top local brands.

Lucrative Data Plans To New And Existing Consumers

Indian brands can collaborate with Jio, Airtel and other leading telcos to offer lucrative data plans to Indian consumers. Existing consumers should also be included in the list via some monthly benefits to maintain the consumer base.

Investment In R&D, India-Centric Content (Apps, Local Language Support, etc.)

While there's no shortage of Chinese branded phones that offer vernacular language support and India-centric content, local phone brads can dig in even deep to come up with even more interesting and useful content. Local content from regional markets can be included in the products along with regional languages support. Moreover, heavy investment in R&D is a must for Indian phone brands to formulate new strategies to tap a bigger market share.

Engage Audience Via Promotions And Advertisements On Digital Platforms

Nokia, the veteran brand is a very good case study to understand how the lost market share can be regained in a highly competitive market like India. The brand which almost vanished from the Indian smartphone space has once again managed to tap a good market share. This is achieved by focusing on promotions and advertisements on the top digital platforms. Local brands can also explore various advertising channels; however, a strong product portfolio is the first step to start with.

Multi-Channel Sale Strategy & Robust After Sales-Service Support

Buyers in India have the flexibility to move from offline to online and vice versa as per their requirement. The Chinese brands, which started as online-only sellers are now focusing more on building their offline channel presence (which accounts for 60% of the market) in order to tap the demand from smaller towns and cities. OPPO and Vivo are great examples. Indian brands are already very much active in the offline space. However, with big Chinese players such as Xiaomi now putting efforts in building and managing the channel ecosystem with heavy promotional activities at the retail front, things are destined to get even tougher for local brands. Having said that, local brands have to be much more aggressive now, both in online and offline space. Lucrative benefits to consumers in the form of easy EMI plans, launch offers, etc. also needs to be integrated within the product portfolio to regain some lost market share.

Moreover, Indian local brands also have to ensure a robust after sales-service network. Reports mention that consumers are not much happy with the service support offered by Indian brands. In addition to the company-owned service centres with good reach in tier II and tier III cities, brands can also offer some additional benefits to consumers like device ‘Pick and drop' service, standby device support, one-day issue resolve, etc. Dedicated consumer request apps can be integrated in the mobile devices with 24x7 service support benefits.

Focus On Smartphones Which Will Cost Rs. 5,000 Or Less

As we are yet to get some concrete details on the Indian smartphone brand's future strategy to fight the Chinese counterparts, we again reached out to data and research agencies to understand what can work for the local manufacturers. As per IDC, the price bracket of INR 5K and below is one segment which has a lot of potential for FTBs - First-time buyers of smartphones and consumers shifting from feature phones to smartphones. IDC further mentioned, "New product portfolios equivalent to the other Chinese rivals in order to get registered in consumer mind back again along with pricing which can be matched to industry average can be a good start". CounterPoint Research states, "The only way for local smartphone brands to sustain in the market is to offer products at entry-level price segment with better specs."

Lava: The Only Local Brand To Show Positive Growth In Smartphone & Feature Phone Segment

Among the Indian smartphone brands, Lava responded to our query on future plans and strategies. The company sees a huge potential in the sub-14k price segment. The company stated that the affordable price bracket segment today stands at $113 billion (Rs. 11,300 crores) with a CAGR of 15% over the last five years and Lava can emerge as Global leader in this segment.

At present, only Lava seems to have the potential to take up the task. As per information shared by Lava, the company owns an SMT (Surface Mount Technology) plant dedicated towards local manufacturing of PCBA (Printed Circuit Board Assembly) units, which is a critical part of a smartphone manufacturing. Having an SMT plant is aimed at contributing further towards the Government of India's ‘Make in India' initiative; by having a substantial part of Lava phones being made in India. It is worth mentioning that some components like battery are still sourced from overseas markets.

Another study conducted by IDC states that the demand for 4G Feature phones is already dampening the growth of 2G feature phones where these local vendors are operational. The report also mentions that the overall increased import duties in the past one year; along with currency fluctuation had already made small vulnerable players exit the mobile phone business. The same has further impacted vendors who are not manufacturing locally in India, thus increasing cost pressures. Resultant, none of the local vendors have any plans to launch 4G devices owing to the unmatched subsidy offered by Reliance.

Coming back to smartphones, the Indian market is highly competitive and demands thorough R&D and powerful product portfolio to establish a name. We at GizBot also believe that a good ecosystem of spec-heavy phones with India-centric software apps and services, along with compelling data plans, and robust after-sale service support can help Indian smartphone brands regain some market share.

As mentioned, the local brands have to make some big changes in their approach towards reaching the Indian consumers, which are now smarter than before and have better understanding of technology. Strong product portfolio, aggressive pricing, Multi-channel sale strategy, lucrative data offers and heavy investment in R&D are the ways forward. In the end, if the Indian phone brands manage to board the 5G train on time, they can survive in the highly competitive market like India. It will be interesting to see how Indian smartphone brands fight back the Chinese invasion in the homegrown market. We will keep a close tap on other local brands and will update the story as soon as we get concrete inputs from other Indian phone brands at various fronts.

CommentsMost Read Articles